Payroll

Once you have been established as a business, the next step is to choose how you want to process payroll and how you want to pay your people.

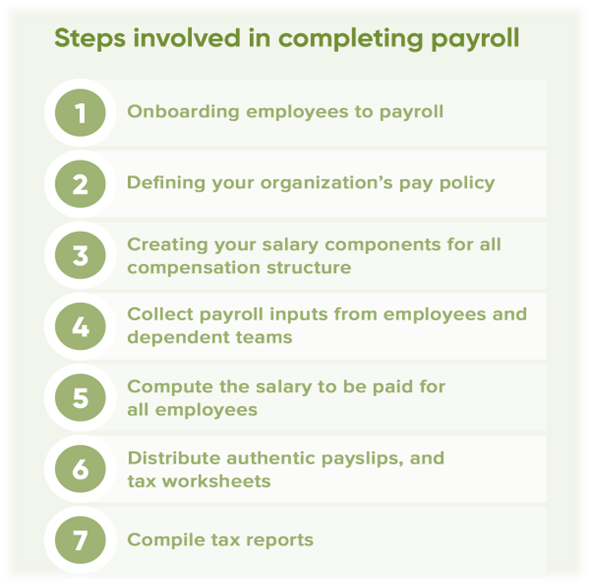

As a business function, here’s a high-level overview of the series of steps involved in completing payroll successfully from scratch. As a result, payroll can be defined as the process of paying company’s employees so that they can arrive at a monthly disposable income.

From beginning to end, USBARE, LLC will process your payroll which involves setting up your business as a taxpaying entity in the eyes of the government and collecting your employees’ information, after which you can begin to calculate their pay, distribute additional funds like tax and benefits payments, issue paychecks, and complete the payroll process with record keeping.

Those identity numbers and accounts include:

- An Employer Identification Number (EIN) from the IRS

- An Electronic Federal Tax Payment System account (EFTPS) to pay federal taxes online or over the phone

- State and local government employer ID numbers (where required)

- State unemployment insurance account (SUTA), as detailed on your state’s Labor Office website

- A state new-hire reporting account

- A state worker’s compensation insurance account

USBARE, LLC will act as your payroll specialist who will focus on your payroll responsibilities, payroll performance and payroll-related matters in your business. We will take the necessary steps to ensure that your company’s payroll is handled accurately and professionally.

USBARE, LLC, Steps of the Payroll Process starts from beginning to end. Processing payroll will involve setting up your business as a taxpaying entity in the eyes of the government while collecting your employees’ information, after which we can begin to calculate employees pay, then distribute additional funds like tax and benefits payments, issue paychecks, and complete the payroll process with record keeping.

First we set up your company accounts on one of the top payroll system in order to be able to run payroll, your business must be known to the federal and local government as a business entity; so we set up appropriate accounts in order to hold funds for paying taxes and fees for the operation of your business. As a result, USBARE, LLC will set up

Those identity numbers and accounts which includes:

- An Employer Identification Number (EIN) from the IRS

- An Electronic Federal Tax Payment System account (EFTPS) to pay federal taxes online or over the phone if you choose to do so

- State and local government employer ID numbers (where required)

- State unemployment insurance account (SUTA), as detailed on your state’s Labor Office website

- A state new-hire reporting account

- A state worker’s compensation insurance account

From beginning to end, USBARE, LLC will process your payroll which involves setting up your business as a taxpaying entity in the eyes of the government and collecting your employees’ information, after which we can begin to calculate their pay, distribute additional funds like tax and benefits payments, issue paychecks, and complete the payroll process with record keeping.

Gathering Employee Information from your company

USBARE, LLC will ask that the companies gather the following information’s for a smooth payroll transition:

Here’s the full list of information you must gather for every employee:

- Full name and address

- Employee or independent contractor status

- Social Security number or EIN from IRS Form W-4 (for employees) or Form W-9 for contractors

- Employee tax withholding information from Form W-4 (not generally necessary for independent contractors)

- Rate of pay and other earnings such as sales commissions or tips

- Whether their earnings are subject to garnishment

- Which employee benefits they have chosen that require withholding

- Direct deposit bank account information (if that’s how you issue pay)

- Form I-9, verifying eligibility for U.S. employment

- Exempt or nonexempt status

Typically, we will ask each business to give us the pay period for its employees on one of four basic scheduled periods: monthly, biweekly, semi-monthly, or on a weekly basis. When you choose to pay employees is up to you, although there are some laws that dictate how employees must be paid.

USBARE, LLC will comply with governmental regulations and withheld the necessary taxes as follows:

The three types of payroll taxes withheld are:

State and Local Taxes

Payroll taxes vary from state to state, and some states like say Florida, Alaska, Tennessee have no income tax at all, although most cities and counties do collect taxes. Withholding requirements and deposit schedules may also vary by location, so it’s a good idea to check the requirements in your state and locality.

Federal Income Tax

This is collected by the IRS based on the amount an employee earns and the number of additional allowances they claim on Form W-4. IRS Publication 15 has more information on this topic.

FICA Tax

FICA stands for the Federal Insurance Contributions Act, but you’ll likely recognize it as Social Security and Medicare taxes. Employers contribute FICA taxes as a direct match with their employees. The tax rates for FICA taxes can change every year, making this an essential update for withholding calculations. IRS website provides for more information.

Additionally, USBARE, LLC will withheld and disburse the Employers share of Taxes to be remitted to the various governmental entity as well.

Employer Taxes

FUTA

FUTA stands for Federal Unemployment Tax Act, and it is the law requiring employers to pay unemployment tax. Employers must contribute 6 percent of the first $7,000 paid to each employee each year to FUTA taxes.

SUTA

The State Unemployment Tax Act is the state-level equivalent of FUTA, above. Like FUTA tax, SUTA taxes are paid as a percentage of initial earnings; however, every state determines its own SUTA tax, so it’s critical to stay up-to-date with your own state’s SUTA guidelines.

Keeping accurate records of your payroll isn’t just wise from a general business finance standpoint—it’s also required by law. Federal law requires employers to maintain accurate payroll records for three years, and accurate payroll tax records for four years.

At a minimum (and this should not be taken as legally binding advice) you should keep the following records of your payroll and payroll taxes:

Once payroll is processed, USBARE, LLC will continue to do the employers work. Additionally, employers must send payroll taxes withheld to the appropriate government agencies. The employers also have to pay the employer portion of payroll taxes via Form 941. USBARE, LLC on behalf of each company will file, on a timely basis, this quarterly federal tax return reports an employer’s federal income taxes and FICA taxes withheld during each calendar quarters.

In addition to Form 941, Form 940 reports any federal unemployment tax (FUTA) employers withheld during the calendar year. Depending on where your business conducts business, you might also have to submit state payroll tax filings and other payments.

A major benefit of having USBRE, LLC processing your payroll is their ability to produce a variety of reports that simplify accounting procedures and help companies ensure they are in compliance with legal and tax filing requirements. Our payroll service will also maintain records and can quickly sent to you if needed for any reasons.